Graeme Pearce

Graeme Pearce

Membrane development has reached a plateau of productivity, yet commercial products still face quality and performance issues in the field. What impact are new entrants having on a mature and competitive playing field?

The membrane filtration market is reaching maturity after 20 years of strong sustained growth since the explosion of drinking water opportunities in the late 1990s. In that time prices have fallen to the point at which membranes compete with conventional technology, and there is widespread acceptance of membranes across the spectrum of water applications.

The market has progressed with all the classic characteristics of a newly emerging market which has disrupted the status quo. The initial hype led to a meteoric rise of the early stage market around 2000. This was followed by a pronounced trough of disillusionment as users soon realised that membrane fibres became damaged by aggressive design fluxes. The slope of enlightenment followed as pressure decay testing became mandatory for drinking water, which gave confidence that long term treated water quality targets could be met.

Arguably the plateau of productivity has now been reached. However, it has taken a while to get to the position of relative calm that we observe today, and commercial products still face quality/performance issues in the field.

Nevertheless, there are still major questions that can be asked about the membrane market, and some concerns about the suitability of products and/or applications for the membrane filtration duties which are performed.

Furthermore, assumptions made along the way about market growth and direction have not always turned out as expected. This article poses four key topical questions about the market, and seeks to shed light on what we can expect in the future:

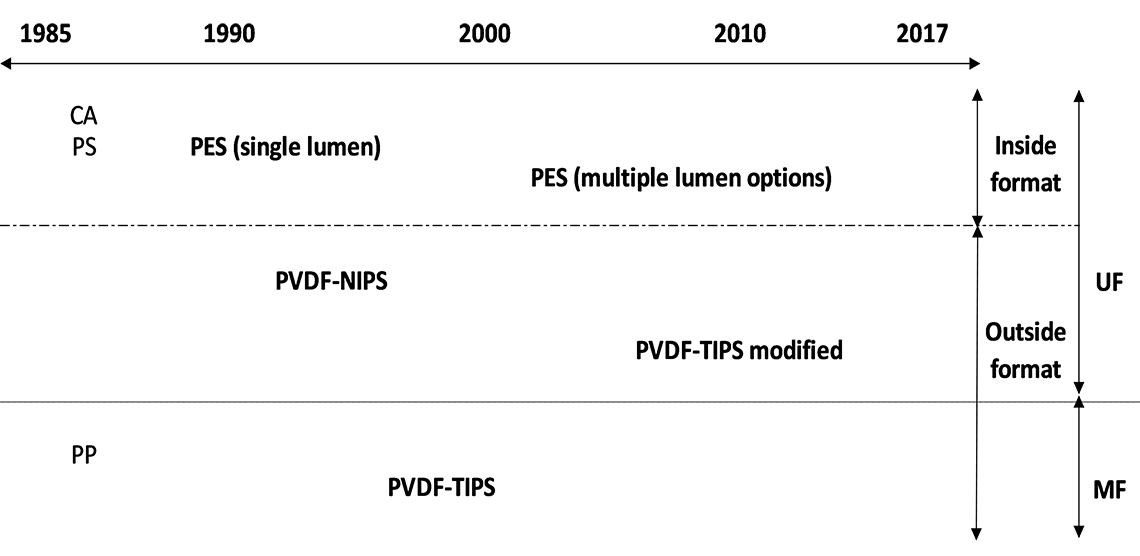

Figure 1 shows the development of polymer options for the market. The original polymers on which the market was founded are shown on the left-hand side of the diagram. They have gradually been replaced by two polymer families denoted in bold type face, i.e. PES and PVDF, which now dominate commercial products. The top dotted line shows the distinction between polymers offered for the inside feed format (primarily PES) and the outside feed format (exclusively PVDF), while the lower dotted line shows the distinction between many options which offer UF, and the few options available for MF.

For both PES and PVDF, the original products were dominated by a manufacturing process based on the non-solvent induced phase inversion (NIPS) process, which creates an asymmetric structure. To enhance permeability, fibres were created with a thin wall and a thin surface layer. Over time, manufacturers have significantly enhanced the strength of the fibre and most have increased the wall thickness so that today’s products are significantly superior to the early entrants.

In parallel, other manufacturers have introduced different manufacturing techniques to address problems at a more fundamental level. In the case of PVDF, this has been based on the use of the thermal induced phase separation (TIPS) manufacturing technique, which tends to produce a stronger fibre with somewhat lower permeability and a more symmetric cross section. These fibres have good resilience to both breakage and abrasion.

In the case of PES, multiple lumen fibres have been produced in which a larger capillary is created with seven internal lumens. These fibres eliminate concerns of excessive pressure and are effectively unbreakable in the context of normal operation.

Alternative polymers occasionally surface but have struggled to break the status quo regardless of merit due to the maturity of the sector.

In terms of suitability for specific applications, the following generalizations can be made.

Membranes have been widely adopted for water treatment since they provide a barrier technology. For industrial water treatment duties, the benefits are clear, and UF and MF has been used for process duties, to filter water as a process fluid, and as a pre-treatment, particularly for RO.

Wastewater reuse has also benefitted. Prior to membranes, chemical and energy use of conventional pre-treatment to RO were excessive and RO performance unstable. In contrast, UF/MF ensures RO stability. Furthermore, a UF/MF barrier provides a more reliable barrier to micro-organisms than RO. The combination of membrane steps has now become mandatory to achieve the overall barrier required for any reuse application in which there is the possibility of human contact, such as aquifer recharge, recreation and even some irrigation applications.

Drinking water treatment has welcomed membranes, but the issue of integrity continues to pose challenges. The early inside feed format products used aggressive design fluxes which led to the possibility of over-pressurization and splitting of the fibres. Also, fibres could break at the potting interface. Outside feed formats also suffered integrity loss, but this arose from abrasion during excessive air scour or as a result of contaminant particles on the membrane surface. Problems have been much reduced as design fluxes have become less aggressive and the early stage products have been replaced by new more resilient versions.

The combination of improvements for the original products with enhancement offered by these new approaches, and more benign operating conditions have enabled the market to achieve maturity.

Nevertheless, ceramic membranes have seized the opportunity raised by product concerns and started to make in-roads in the drinking water market. Testing integrity itself incurs downtime. Repairing broken fibres is a modest additional expense for most plants, but for the troublesome few, costs rapidly spiral and downtime becomes unsustainable. Ceramics reduce the frequency of testing and avoid repair, and significantly higher flux virtually pays for the higher investment cost. However, it has yet to be established however whether long term permeability trends are sustainable.

The final application for water treatment is pre-treatment for seawater desalination. This application is the most recent, having only been significant since 2006. On a level playing field comparison, UF/MF does a better job in ensuring RO stability and competes on price with conventional technology.

It was first recognised in the early 1990s that SWRO suffers from bio-fouling for systems that use continuous intake chlorination due to the creation of organic breakdown products not removed by the pre-treatment. These breakdown products provide a nutrient for bacterial colonies and encourage the development of bio-films in the RO. The RO manufacturers have recommended that continuous intake chlorination is avoided and instead recommend shock chlorination, or better still, mechanical cleaning of the intake.

SWRO plants with conventional pre-treatment have tried to avoid continuous intake chlorination for many years. A review of 16 plants using spiral wound RO presented at IDA conferences between 2007 and 2017 shows that none of these operations use continuous intake chlorination.

However, some SWRO plants have been built on sites with an existing intake shared with other users. In most cases, a shared intake is continuously chlorinated since this is beneficial for other users. Accordingly, such intakes pose a problem for RO plants.

Unfortunately, a significant proportion of installed plants with UF pre-treatment are on sites that have a shared intake subject to continuous chlorination due to the perception that UF pre-treatment would be better at handling the more difficult intake condition. This has created a much more challenging feed for UF than for their conventional counterparts due to the hope/assumption that the better removal performance of membrane pre-treatment would allow corners to be cut elsewhere in the process flowsheet.

A survey of UF-SWRO plants has found that of 24 systems with membrane pre-treatment, nearly 40 percent had a feed which had used continuous intake chlorination. There are two options available for the RO to ensure stability. Either the plant needs an adsorption stage in the flowsheet, which is highly unusual due to the additional capex, and not used for any of the 24 plants in the survey. The adsorption stage could be based on granular or powder activated carbon, or on a novel approach recently introduced by Hitachi Metals called the Ceramic Adsorption Filter (CAF).

Alternatively, the feed needs on-line dosing of a biocide for which there are several commercial options with drinking water approval, for example from Kurita and Nalco. Though expensive in operating cost, this approach is feasible for small and potentially for medium sized plants due to the significant saving in intake cost. Also, it is likely that coagulant dosing would not be required.

The comparison of UF and conventional pre-treatment is therefore not straightforward. UF can provide a very effective solution, but it should not be assumed that UF will solve bio-fouling problems without making provision for the effect of breakdown organics. Hopefully, as the industry considers these two pre-treatment options on a level playing field, the benefits of UF will be acknowledged.

Ceramics could also have a role to play in pre-treatment since the hydrophilic character of the surface combined with the chemical resilience of the membrane would allow alternative process flow options to be considered which may overcome RO bio-fouling issues. One possibility could be to use ozone pre-treatment of the feed, since it could eliminate the problematic organic breakdown products. However, this approach may prove too costly. Alternatively, the UF could use an ozonated backwash to improve performance stability.

The holy grail for the users and engineering firms has been to create a UF replacement market that resembles the RO market, and to sell UF in a system which would effectively offer an ‘open platform’, i.e. a system potentially compatible with the products of different UF manufacturers. RO consolidated around in single format concept, i.e. the spiral wound element, and in the early stages started to use interchangeable product dimensions.

In contrast, UF/MF still uses different formats, and within those formats, different modules dimensions. UF/MF is normally sold as a standalone module rather than as an element to be used in another supplier’s pressure vessel, and this has made it almost inevitable that differences between suppliers would be perpetuated. Even in regions or applications in which a single format has emerged as a clear leader, differences persist, because it is the interest of suppliers for their modules to have unique features so that they can be assured of winning the replacement business.

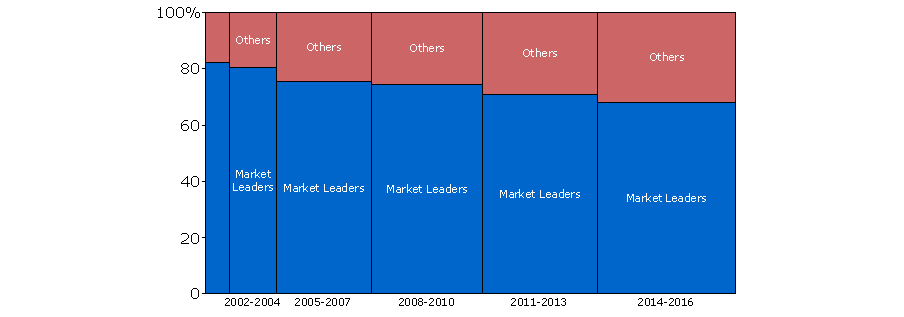

In the last few years, this has begun to change as illustrated in Figure 2 which shows that surprisingly, the market is becoming less consolidated as it matures. The width of the columns shows a steady growth in market size.

Within each column, the share is divided between the four market leaders, which each individually have a share of >10 percent, compared to the others comprising the smaller players and new entrants. Despite the difficulty in gaining traction in an established market, the smaller and/or newer players have been successful in winning share relative to the established incumbents.

Figure 2: Consolidation trends in the membrane filtration market

One of the drivers for this trend has been the demand from users and engineering firms for modules to be potentially interchangeable to ensure competitive prices and protect end users from the possibility of their chosen supplier from going out of business. Also, the possibility of switching to an alternative supplier in the future ensures that the system keeps up with product development and innovation.

In response to this need, several membrane system specialists started to sell systems which included ‘universal racks’, i.e. racks which could be used with modules from more than one supplier. In reality, dimensional differences and differences in porting arrangements meant that it would be quite unusual to replace the original supplier with a different option, but at least the threat exists.

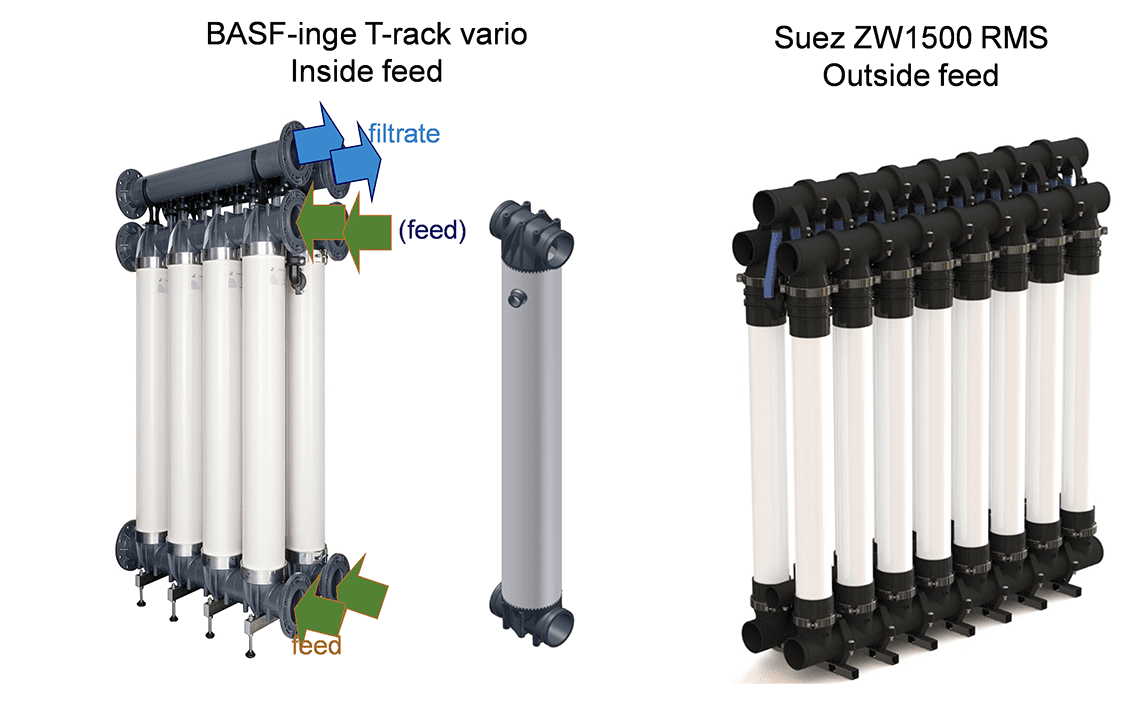

Membrane suppliers countered with an alternative approach to the open platform, i.e. the so-called ‘integrated header’. In this concept, module end caps are connected directly eliminating the manifold, thus effectively eliminating the rack altogether as shown in Figure 3 for two of their strongest proponents of this idea for the two different formats.

The compete integrated header assembly becomes the potentially replaceable component, allowing one manufacturer’s unit to be replaced by another. The concept has proven popular not least because it provides a very cost-effective system. The possibility of changing out from one manufacturer to another is a concept still in its infancy.

Now, a significant change has come to the market, with the first manufacturer focusing on module replacement sales, namely the Chinese manufacturer, Scinor.

In particular, the US subsidiary has aggressively pursued replacement opportunities, taking advantage of the large number of systems that now require new membranes due to age, and in some cases, due to integrity concerns. Scinor offers a robust PVDF TIPS product at lower pricing than other suppliers and has developed a range of products which exactly mimic dimensions and configuration of all the widely used mainstream players. Whether this creates a sustainable business model or is just allows end users to keep replacement costs in check, remains to be seen.

However, it does help to justify the universal rack, since in every case, there is at least the option of the original membrane supplier and Scinor without making any rack modifications.

The UF/MF membrane market coalesced around the choice of PES and PVDF in the 1990s, with one option offering ceramics. The early providers were mainly small companies at the early stage struggling to gain acceptance for a nascent technology. Gradually, these companies grew and/or were acquired by larger players. Now, all the established suppliers are owned by large corporations and new entrants experience great difficulty in breaking into the market, especially if they are attempting to introduce a novel material. This section will consider four examples.

The first is the Water Planet spin off, PolyCera. Their membrane is based on polyaniline, which has been considered historically, but not commercialized. The membrane seems to be capable of performing in difficult applications, but has struggled to gain traction, and not attempted to join the mainstream.

A second example is Nanostone, a ceramic supplier with an alumina-based membrane like the only established ceramic incumbent in the water sector, Metawater. The company has won references, but it is too early to tell whether it will make a major impact.

The third example is a Dutch company IMT. This company has a multi-lumen technology using PES which has similarities to the BASF-inge product. As a standalone company, IMT struggled for recognition for several years, but since its acquisition by Suez in 2016 has achieved significant growth, achieving critical mass in mainstream applications very quickly.

Finally, an example from RO is Nano-H2O. The company received enthusiastic press coverage, but very few sales prior to its acquisition by LG. The intriguing premise was based on incorporating nanotechnology into a tried and tested format to boost performance, but the marketplace was cautious when it came to putting the membranes to the test. However, since the acquisition, major references have been won and LG-Nano is now a significant world player for the new tranche of major SWRO projects.

The lesson seems to be that ‘might is right’, particularly at this stage of the market. A new entrant can therefore look for sales of its product, but its real aim should be to look for sale of the company. Without major backing, new start-ups tend to languish, no matter how attractive their technology.

In the early 2000s, China began to implement UF as a pre-treatment to RO in the rapidly expanding power sector. Indeed, conventional pre-treatment was hardly ever considered, and UF became the normal choice across a broad range of industrial water treatment duties.

By 2007, the market was very significant, and second only to the US as a national market for UF. The beneficiaries at this stage were largely foreign suppliers, though margins were gradually squeezed by the threat of new Chinese suppliers. At this stage, the government plan foresaw a complete turn-round of the market by 2017, with UF supply changing from 90 percent foreign to 95 percent domestic in a decade.

Dow purchased one of China’s largest domestic UF suppliers, Omex in 2007. Production was internationalized, which increased cost, but made the product competitive for international markets. Very few other Chinese suppliers followed suit, though there were several JVs between international players and Chinese companies, e.g. RO manufacturer Toray. Also, other companies invested in partial RO manufacturing, most notably Nitto.

In contrast, the Chinese companies in the MBR market have been relatively more influential due to the exceptionally high growth of MBR in China, an issue that with be discussed in detail in a forthcoming Tech Dive article.

For the future, China is seeking to invert the original paradigm with its companies and investors becoming the acquiror rather than the acquired. Two recent examples are the acquisition of the ceramic specialist ItN Nanovation by SafBon, and the UF/NF specialist AMS by Newater Technology. In both cases, the acquired company had noteworthy technology but a small market presence. However, it could be a sign of things to come as Chinese investors become more ambitious.

- Dr Graeme K Pearce is director of Membrane Consultancy Associates.

[1]Membrane Biological Reactors: Theory, Modelling, Design, Management and Applications to Wastewater Reuse (Chapter 14: Commercial Technologies and Selected Case Studies, G K Pearce)

Edited by: Faisal I. Hai, Kazuo Yamamoto and Chung-Hak Lee, IWA Publishing, 2nd edition, 2019

Director

Membrane Consultancy Associates