Point of use (PoU) systems can alert consumers via apps exactly when filters need changing. How far can this data go? How will technologies eventually be grouped together to offer an ‘iPhone’ type sales experience? Our article investigates the drivers and developments in the PoU market.

In a post-Flint water crisis era, the market for point of use (PoU) systems could see substantial growth beyond the traditional countries of China, India and wider Asia.

Estimates from BlueTech Research suggest that annually 80 million PoU units are shipped, with China accounting for 15 million.

In its 2019 insight report on PoU, the company estimated the geographical market split with Americas accounting for 40 per cent, Asia-Pacific 35 per cent and Europe, Middle East and Africa 25 per cent.

Prices vary from as low as $50 for lower-end products, right through to $2000 for the high end, leading to a market size in the region of billions of dollars.

Consumer concerns over drinking water taste and odour have historically driven the market but now questions over water quality are becoming a major factor.

Low-income households in developing countries lacking municipal water infrastructure have historically purchased PoU systems to help avoid risks of illnesses from consuming microbiologically unsafe water.

Furthermore, increasing industrial activities in South East Asia have led to groundwater contamination from heavy metals and other contaminants. As a result, PoU systems in these markets are suggested to be seen "as a complementing solution rather than competition to utilities".

Historically, when trust in tap water quality and water utilities is high, such as in the Netherlands, for example, the market for PoU systems generally remains very small. However, this could soon start to change.

"While domestic use of PoU and Point of Entry (PoE) systems is already a firmly established trend in India and China, we see this concern growing in the US and Europe as people become more aware of issues such as the range of micropollutants that are not necessarily removed from drinking water by utilities, such as pharmaceutical by-products, for example," says Paul O'Callaghan, CEO of BlueTech Research.

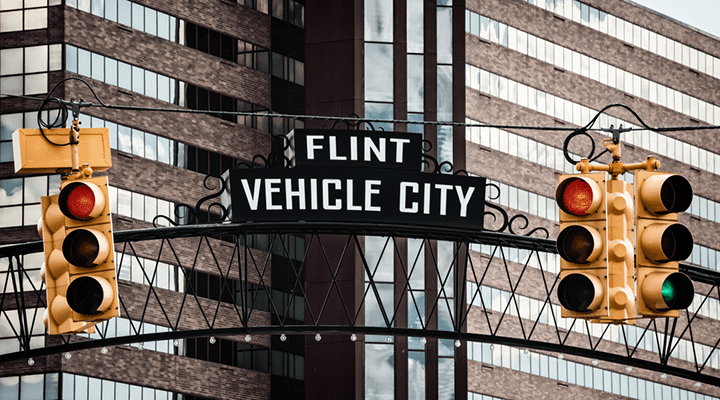

The Flint water crisis continues to come up in discussions on water quality and the role of water utilities.

It was in 2014 when a new pipeline was under construction and the city water supply was switched to the Flint River. Shortly afterwards reports emerged of changes to the water's colour, smell and taste. Tests from the EPA and Virginia Tech in 2015 found higher than normal levels of lead in the water of residents' homes.

"When water quality issues reach the news, people start searching for solutions so that the problem does not affect them (too much)," says consultant Dr Corina Carpentier, ecotoxicologist and managing director of Benten Water Solutions.

"In the case of water quality, people generally see two options: switch to drinking bottled water, or install a PoU treatment device."

Interestingly, the following website shows how news items affect what people search for, using the example of the Flint water crisis a few years ago. Despite the 2,700 different search items associated with the crisis, it was only until the President stepped in that the search traffic jumped.

"Local news cycles do not generate as many searches as national news: searches spiked when President Obama made a statement about it," adds Carpentier. "Important to notice is also that as soon as the item disappears from the news, interest seems to disappear quickly as well. Thus, sales agents need to make the most of things in a fairly short period during and just after a water quality event. Even events as impactful as Flint do not seem to have a lasting effect."

Another issue driving consumer awareness to look for PoU solutions is the widespread discovery of the family of chemicals known as Per- and Polyfluoroalkyl Substances (PFAS), says Chris Wilker, executive VP of new business at the Canature WaterGroup and past President of the Water Quality Association (WQA).

The Environmental Protection Agency (EPA) is working on setting a maximum contaminant level (MCL), as part of a wider action plan.

According to the WQA, its Consumer Research Study showed significant increases in consumer awareness and concern related to the quality and safety of their drinking water from the previous 2017 survey.

This increase in awareness and concern was consistent between consumers being served by private wells or by centralised or municipal supply, the organisation added.

"There is no shortage of traditional and social media attention focused on water contamination and drinking water contaminants," says Steve Ver Strat, current President of WQA and regulatory policy advisor at Amway.

"This is an emotional topic and highlights the occurrence of known and emerging contaminants, and with that stress, the potential known, or in some cases alleged health effects. How can such attention do anything more than heighten consumer concerns and drive consumers to seek solutions that put them in control?"

One of the latest developments or natural evolution of home PoU systems is the digitalisation of the technology: more connectivity, more data and giving consumers more information about their system and water.

Companies including Eco Water Solutions, Kinetico Water Systems, Canature WaterGroup, Culligan Water and others are all reportedly working on apps and connected technologies.

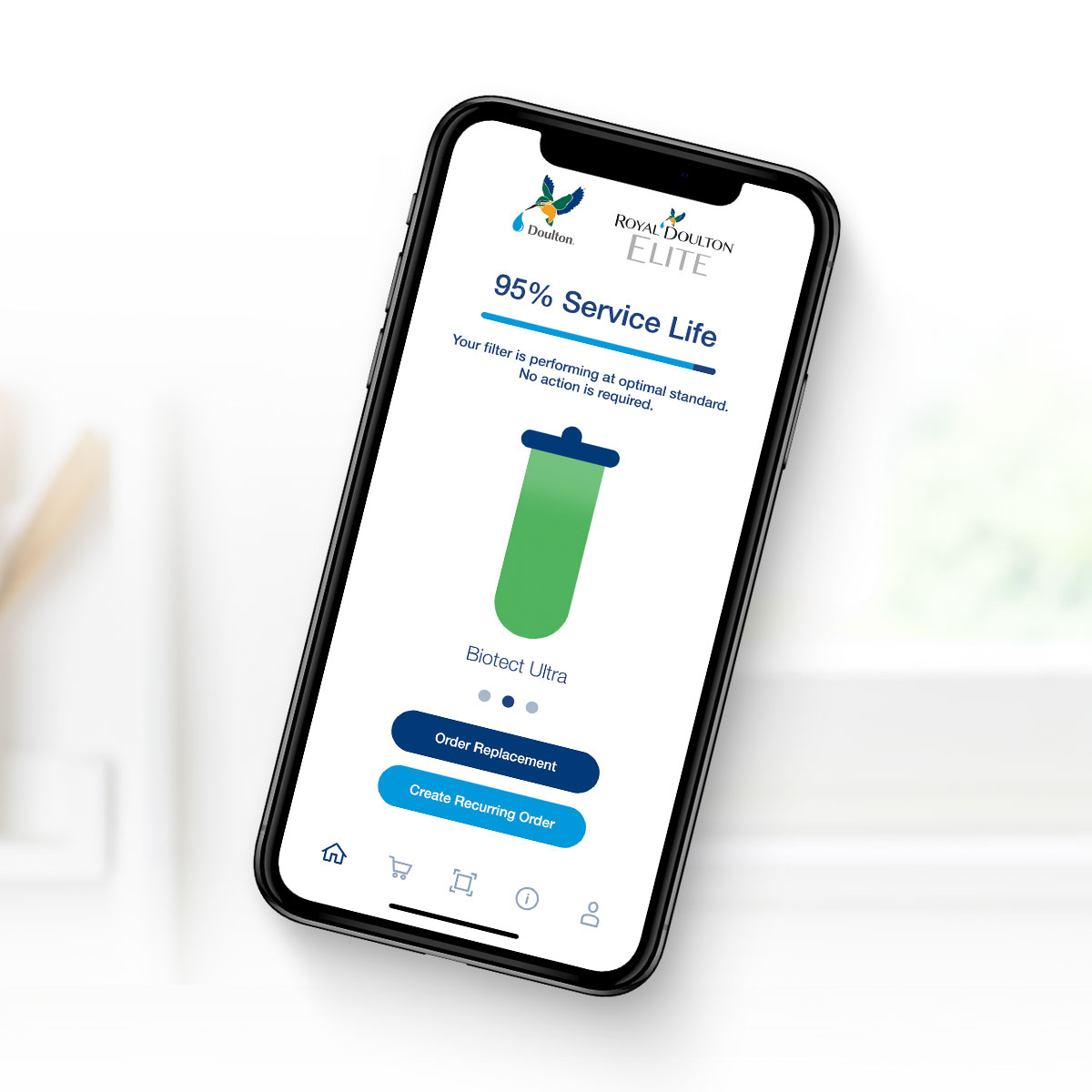

UK company Doulton has developed what it calls 'FILTACHEK'- an app to help people "monitor the service life of their water filter element and receive a notification when it's time for a replacement".

Image credit: Doulton Water Filters 2019

Rolled out in the UK market in November 2018, the app was in development for four months. It issues alerts based on time or consumption to ensure consumers are informed and aware of the need to order a filtration replacement.

"This is part of our 'fit it, don't forget it' messaging to customers," says Yvonne Allen, marketing manager from Doulton Water Filters. "Over time, the performance of filters starts to diminish naturally, and your palate becomes accustomed to that changing taste. We advise people to change the filters every six months, and the app is proving effective in reminding people and generating that replacement order."

The company is also working on an app for the Indian market but based on water quality where, depending on the local water quality challenges, different levels of filtration will be recommended for customers.

The Pollet Water Group (PWG), a global distributor of water treatment solutions, believes the benefits of digital solutions will go beyond the consumer market.

Micheline Verhaeghe, technology intelligence engineer at PWG says the digitalisation of PoU devices will “find entrance in the high-end markets where PoU water treatment is more a luxury than a basic need”.

She says: “We may not forget that next to consumers who want to control their data themselves, there are also bigger utilities and hospitals who want to outsource the water management. Both have a huge potential for digitalisation (or digital servitisation) going from smartphone apps for end customers to remote data control for predictive maintenance by the water treatment company”.

PWG has developed a cloud-based ‘Manage My Softener’ platform for its Wi-Fi connected softeners. A smartphone app enables customers to check their water usage, with a message being sent when they need to refill the salt. Data is also available on the incoming and outgoing “water hardness” and remaining capacity.

Meanwhile Canature’s Wilker believes that the "connected technology" part of the business is really going to add value to the overall PoU package, and enable the market appeal to millennials who are simply "not going to buy systems via the traditional ways we sell".

"Instead of a POU product sitting under a sink with the customer not knowing how the unit is performing or when to change the filters, our new connected technology will engage the consumer in real-time on product performance and filter life," he says.

He adds that his company is focusing on the development of "smart products" that will "really connect the end-user to the product performance".

In terms of adding additional sensors to PoU systems, Wilker says the "real win will be what the sensors can do" and predicts that eventually, there will be "specific contaminant sensors deployed" including lead sensors but that the price "needs to come down".

The executive VP of new business also observes that as the PoU systems become more digital, it will also need the installer skillset/value chain to evolve at the same time.

Instead of the dealer, plumber or installation company just fitting a PoU system under a homeowner's sink, they will eventually have to connect devices with routers, for example, branching into telecommunication engineers' work.

Meanwhile, Carpentier believes manufacturers are reluctant to add on sensors and data too quickly as it could disrupt traditional service packages.

"We noticed that companies selling PoU treatment systems generally are not very keen on having their equipment fitted with sensors," she adds. "They usually sell the equipment together with a maintenance contract, which includes preventive changing of the filters once or several times per year. A sensor could potentially indicate that the filter does not need to be exchanged yet, and thus would undermine their (after)sales strategy."

The managing director adds that early detection of problems in-between maintenance events "is also not wanted, because that could undermine the feeling of security that consumers have when they have a PoU treatment device installed".

PoU systems can include the following technologies, depending on the target pollutants and the required level of treatment:

Some believe that as consumers push for purer water, it will spark the emergence of "hybrid" PoU systems, bringing together multiple technologies.

Oliver Lawal, CEO of AquiSense Technologies, says the PoU market will eventually evolve with the buying process becoming like shopping for an iPhone: you have more basic treatment options (iPhone 7), with fewer bells and whistles, right up to the best-in-class water treatment, bringing together multiple technologies, similar to the more expensive iPhone X.

He references a partnership with US company Oasis International. The company's UV-C LED technology has been combined into a point-of-dispense disinfection system, known as Quasar to eliminate water-borne microbes, such as cryptosporidium and E. coli.

"This is constructing a new UV market, for point of use and point of consumption," says Lawal. "We're adding two technologies together, whereas historically they existed and were sold separately."

The CEO says the drive away from plastic bottled water and towards reusable bottles, and public water fountains will be a big driver for his UV-C LED technology.

"People are used to drinking bottled water from a brand they trust, say Nestlé, and need to put that same trust into this water fountain, or home PoU device, if it has UV technology in it," he adds.

To help with this, AquiSense has designed a "visible light on the tip" of many systems, which glows blue when water comes out. "People associate that with something good happening …we're combing UV light with visible light, giving the visual cue to the user of the product, as well as the actual technical verification," adds Lawal.

Some companies have already taken the lead in hybrid products.

Amway's eSpring system combines UV with activated carbon. The "workhorse" of the device is an all in one cartridge, which includes the carbon filter to remove particles and traps and removes 140 contaminants. The UV light then acts as the second "level of protection", which destroys 99.99 per cent of microorganisms, including bacteria and viruses.

Sold in over 50 countries or territories, Ver Strat describes it as a "treatment device that is cutting edge in terms of electronics, efficiency and performance".

He also agrees that the digital environment will "have the biggest impact", from social media to drive brand recognition to the Internet of Things (IoT)/connectivity as a means of monitoring performance and maintenance needs of an installed device.

"This will be critical as the future evolves and these devices gain acceptance as a potential compliance tool," he added.

With the advances in PoU technology and available data, it raises multiple questions:

Currently, PoU systems continue to find their place in countries with advanced water treatment infrastructure. Some believe that if the water utilities are "doing their job", then there shouldn't be a need for additional treatment, nor to put this responsibility to the general public, who are not water engineers.

Others believe that no matter the level of centralised treatment, it can always be the "last mile" of sometimes old, creaking pipework where the contamination can occur and that the "residential PoU/PoE market is better placed to react".

The American Water Works Association (AWWA) acknowledges consumers “may have unique water quality needs which may lead them to use a supplemental home water treatment device”.

Representing American water utilities, the associated takes the stance that these companies should be communicating regularly with their customers about the quality of tap water.

It adds: “Information about home supplemental water treatment devices should emphasise the importance of properly maintaining the home treatment devices so that consumers do not unknowingly affect the safety of their drinking water through improper maintenance.”

Meanwhile, the WQA president is keen to acknowledge the responsibility of water utilities but adds that PoU/PoE technology will give people the ability to react more quickly to emerging contaminants.

"I want to be clear on the point that municipal or centralised treatment providers do an incredible job of producing drinking water that meets the respective national quality requirements," adds Ver Strat.

"They do this in the face of ongoing issues with source water, financial constraints and failing infrastructure. However, given the pace of change, and the identification of new and previously unknown emerging contaminants, maintaining consumer trust and comfort will be an ongoing challenge."

Globally, one saying about the PoU market is that in Asian markets, these devices are seen as "must-have". Modern designed treatment systems can take pride of place in kitchens, becoming status symbols, much like designer coffee machines. Whereas in Europe, they have been seen as "nice to have" additions to kitchen appliances but are often hidden away.

Data-driven consumer products that monitor health parameters such as sleep, number of steps and calorie intake are becoming more popular. So consumers could well turn their interest to water quality data, moving home-treatment systems from the nice to have into the must-have category.

Growing environmental awareness, coupled with a digitally savvy and demanding population, could mean that modern, connected PoU systems could soon be making their way into a house near to you soon.