Leveraging shared use of industry-related infrastructure is one of the ways to ensure water security and economic development, writes Anna Poberezhna.

Water security: reality check

Heavy infrastructure is one of the most complex sectors and the most real in terms of the economic impact: it operates in the environment of existential risk and across all 17 Sustainable Development Goals (SDGs).

I grew up on construction sites watching infrastructure developments, including the 2009 negotiation of the two water supply projects in Saudi Arabia, worth over $500 million.

This gave me an insight into why water security and climate change will and have become two of the most pressing global challenges. There is growing acknowledgement that the material risks and impacts of water security alone are inadequate.

This year has exposed the naked truth about the severity of humanity, the threatening crisis and the fact that stakeholder capitalism is evidently broken.

A clear indicator was in one of the few water trading, key mining countries in the world: Chile. Part of the key demand behind the recent constitution referendum was recognising water and land rights,

Mapuche indigenous population, and powers of collective bargaining.

Ecosystem and water resilience gap

The investment gap is five times bigger than the world economy. As of 2019, this stood at $133 trillion, which does not sound very sustainable, neither from the public sector nor from the private sector perspectives.

Furthermore, the World Bank estimated an incremental annual investment for Sustainable Development Goal 6 is over $100 billion, which is over 40 per cent above the current rate. To that effect, we may want to add the annual investment gap in natural capital investments of $150-400 billion into the mix (CBD, 2012, UNDP BIOFIN, 2018).

Water circle interlinkages

“The 'perfect storm' Once water disappears, it appears elsewhere. Despite knowing this, we are still not proficient in predicting volumes and frequency.”

The water (hydrological) lifecycle can no longer be assessed and managed independently. It is part of the ecosystem and climate: by default, once water disappears somewhere, it appears elsewhere in one of many knows forms. Despite knowing this, we are still not proficient in predicting its volumes, magnitudes, and frequency.

Climate change and extreme events are expected to aggravate water issues, and vice versa, creating a spiral effect.

Many of the biggest challenges created by climate change will ultimately manifest themselves in water issues: all shapes and forms. Higher temperatures will lead to both more megadroughts and more intense rainfall, flooding and storms.

As a result, it’s estimated that by 2025, $145 trillion in assets under management will either be directly or indirectly exposed to financial water risk. In any outcome, water security will be under threat, leading to severe ecosystem impacts, including health, development and growth. Financial and physical water risks are the greatest threats to people, planet and profit.

In addition, there is a clear interdependency between financial stability, its pillars and water, including:

- Ecosystem resilience

- Economic growth (GDP)

- Peace and political stability

- Favourable investment environment (certainty)

- Investment-grade projects/bankable projects.

Reconnecting the dots: What, why, how

Let’s take a step back and look at the root-cause perspective. To ensure water security, we need to ensure water resilience. To ensure water resilience, we need to manage water resources effectively at all levels: policy, strategy, governance and across all verticals of public and private sectors.

I would add ecosystems and communities as standalone groups (first nations, indigenous, and other underrepresented groups in the near past). Moving from words to actions, to bridge the global demand-supply gap and to address water security, the development of infrastructure and application of innovations should be top priority:

- New infrastructure

- Infrastructure upgrade (wastewater treatment, address leakages)

- Innovative infrastructure solutions (for example, green/sustainable and modular infrastructure)

- Natural capital and integrated infrastructure

- Integrated infrastructure and solutions (i.e. Nexus).

Governance and incentive structure

There is complexity around “efficiency-legitimacy-accountability”.

Currently, there are many efforts around accountability and disclosures: more disclosures, more transparent ones, more integrated, and the list goes on. There are at least 10, to name few, that directly or indirectly include water.

Surely, standardised metrics would help, and we can see that the convergence trend is taking place.

So, which one are we lacking? Water security.

However, according to the Climate Disclosure Standards Board (CDSB), only 6 per cent disclose details on water-specific governance; 75 per cent describe their water management strategy and policies, and 66 per cent identify water-related risks.

Whilst investors, communities, governments and policy-makers require more information, companies (private sector) often face a dilemma: spend more time on administration or on management and implementation.

Where do we start? In practicality!

It is a common fact that certain industries are at the forefront of the water security issue: mining, energy, agriculture, textile, and others.

When it comes to the company level, often the underlying primary internal driver is efficiency and its effects in the short and long run: be it productivity or risk indicators - loss mitigation, value at risk and others.

However, to complete the picture, economic, social and environmental aspects have to be integrated into the assessment and planning.

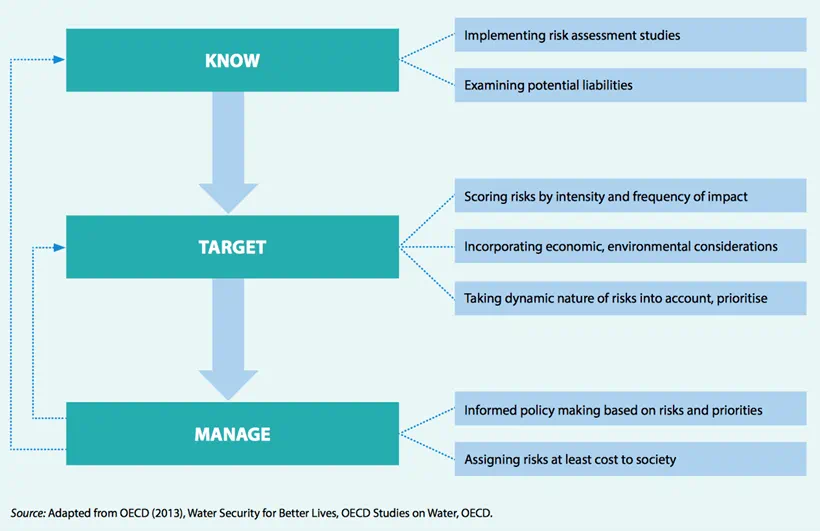

Water risks require systematically assessing and integrating into the decision-making process both in public and private sectors, be it policymaking, investment decisions, risk management or community relations.

Green swans to green assets and solutions

Every $1 invested in water and toilets returns an average of $4 in increased productivity, according to the World Health Organisation. Despite such an optimistic statement, investments in water infrastructure are critical yet remain unattractive due to a number of factors, including:

- Water definition: liability vs asset vs human right

- Value of water (undervalued/incomplete/misperceived)

- Under-priced cost of water services

- The high capital cost of water infrastructure

- Lack of appropriate data and analytical tools

- Local context vs global impact.

To enable water security, we need to accelerate favourable collaborative policies and water-finance on a larger scale. A series of incremental steps are required:

- Water risks-impacts: improved due diligence (inter-stakeholder, intra-stakeholders) and accountability (assessment, measurement/priced, and addressed).

- Golden mean is to be achieved: connecting bottom-up and top-down approaches at horizontal and vertical levels: where efficiency would meet legitimacy and accountability.

- Proactive action: single and collaborative towards not just mitigation, but adaptation and restoration.

- Develop risk transfer mechanisms and focus on lower-capital cost projects, using innovation.

- Last but not least (wearing water advocacy, tech innovation and sustainable finance hats): technology to drive efficiency in all of the above.

Through the looking glass

Like in Alice in Wonderland, we need to look through a lens of opportunity and think creatively about strategy and execution.

Integrated water resource management has been developed for some time now, and we need to interlink it with integrated risk management and reporting to enable scalable and trusted collaborative platforms. Being a millennial myself, I would also suggest we simplify the messaging: no water, no money; no water, no honey.

When I started working in this area four years ago, I thought progress was slower than expected. However, I remain optimistic that there is light at the end of the tunnel.

“ Being a millennial myself, I would simplify it: no water, no money; no water, no honey.”

In a recent LinkedIn post, I asked the question of “Water is…”. This generated 6000 views, 145 reactions 35 comments in a few weeks – more than my formal speech and water-blockchain-sustainable finance presentation at COP 24.

Water security: shared economy and ecosystem collaboration

Leveraging shared use of industry-related infrastructure is one of the ways to ensure water security and economic development in the regions of companies’ operations.

There are numerous positive outcomes which can be achieved through such an approach:

- Minimisation of water footprint

- SDG 6 security for communities

- ontribution to socio-economic development

So, shared economy and ecosystem collaboration is the way forward to minimise, hedge or transfer risks as well as to unlock new business value opportunities for all stakeholders.

We are on a mission, working together with the stakeholders for the stakeholders, inclusively. So join me on a journey of #Makingimpossiblepossible.

Anna Poberezhna

Founder

ClearHub/Smart4tech